Why didn’t altseason come?Many expected an altseason last year, but it never came. While some large-cap tokens did reach new ATHs (BNB, SOL, HYPE), most of them are now down 40–50%.

Let’s break down the reasons.

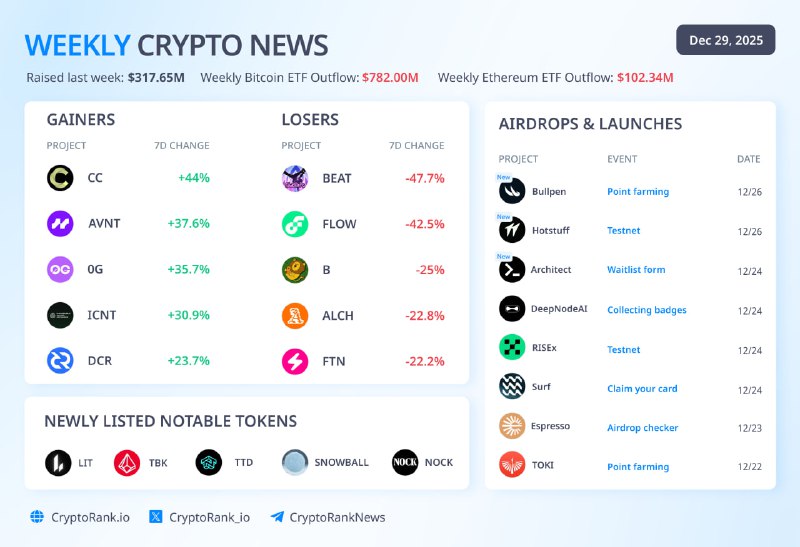

Reason 1 – Capital dilutionNew narratives constantly replace old ones, and previous “runners” quickly become irrelevant. Every year, millions of new tokens enter the market, diluting attention and liquidity. A year ago, crypto aggregators tracked around 5.8M tokens; today, that number has grown to 29.2 million.

In this environment, even newly launched tokens struggle to hold their price. According to the research, only 15% of alts launched in 2025 are trading above their TGE price.

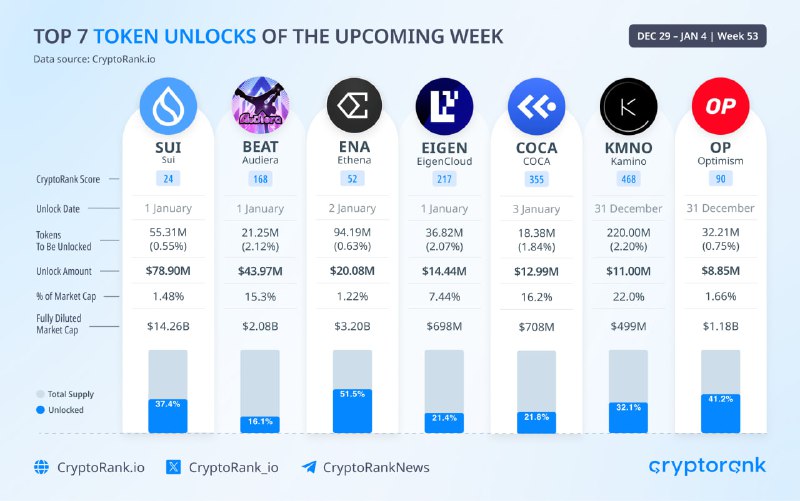

Reason 2 – Low float, high FDV launchesIn 2025, launches of low-float, high-FDV tokens continued. There were fewer of them, but they still held back a broad altseason. With this launch structure, most of the upside goes to early and private investors, while secondary market buyers often end up as exit liquidity.

A small circulating supply at launch inflates valuations on thin liquidity, and later unlocks create constant sell pressure. VC sell pressure can be tracked using a dedicated dashboard on CryptoRank website.

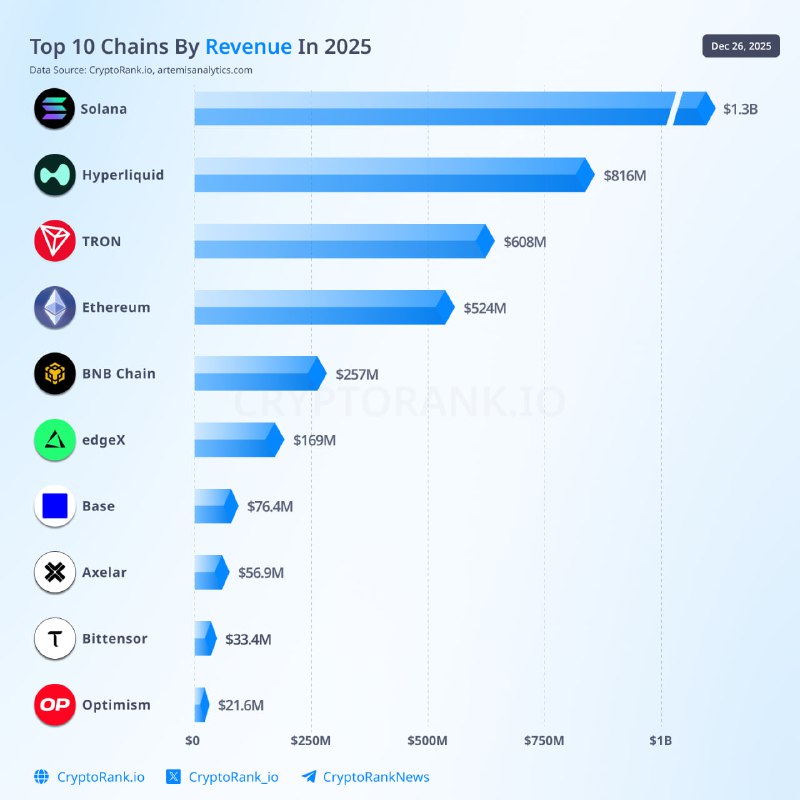

Reason 3 – Competition with other instrumentsA few years ago, altcoins were one of the few ways to grow capital quickly. Today, they are seen more as mid- to long-term investments and have to compete for liquidity with other instruments and sectors.

Early last year, a large share of retail capital moved out of altcoins, especially VC-backed tokens with high FDVs, and flowed into memecoins.

After a series of failures and scams, that liquidity left memecoins as well, but it did not return to altcoins, weakening the market further. While meme trading slowed, other sectors gained traction, most notably perps and prediction markets.

Their growing metrics show retail’s appetite for higher-risk instruments that offer faster returns when conditions are favorable. With this, altcoins are forced to fight hard for user attention and capital.

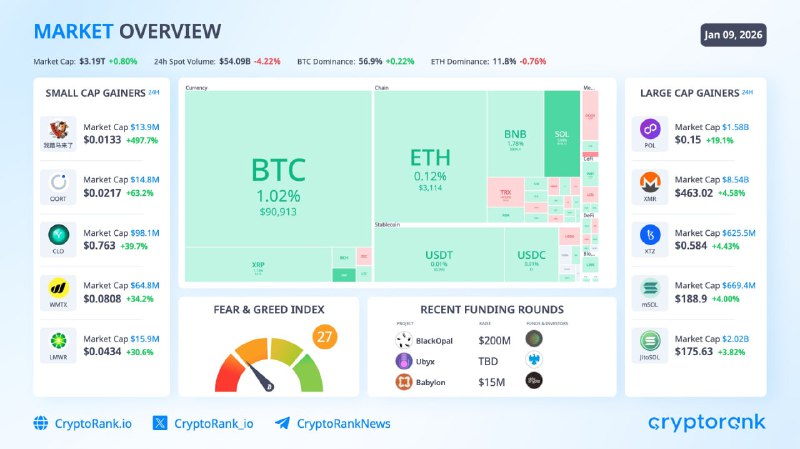

Can institutions help altcoins grow?Yes, but only few of them. In 2025, institutional capital focused on targeted exposure to large, resilient assets. ETH, SOL, and XRP saw solid ETF inflows, while the emergence of DATs expanded regulated access to crypto assets.

ETF inflows supported the market from summer through October, but once outflows began, the trend reversed. In November, BTC ETFs saw $3.5B in net outflows, followed by another $1.1B in December.

Without renewed inflows of large capital, a recovery in altcoins and the broader market remains difficult.

Do you expect an altseason this year?

12.1K views20:54